Achilles + DIRO Supplier Bank Account Verification is now available in MyAchilles to help businesses fight back against authorised push payment fraud (APP fraud). Buyers can request activation via their subscription, while suppliers can start verifying their bank details directly through the platform at no cost.

Procurement fraud is growing at an alarming rate due to the speed at which fraudsters can operate, making it increasingly difficult to discern what’s real from what’s fake. The new partnership between Achilles and Diro enables businesses to safeguard and future-proof themselves against the increasing authorised push payment fraud risks – particular those associated with AI and deepfakes.

This real-time supplier bank account verification tool lets buyers and suppliers confirm bank account details directly from trusted sources like banks and government portals, helping ensure payments go to the right account and reducing the risk of misdirected funds.

How Bank Account Verification Works

- Supplier Consent: Supplier bank account verification starts only when the supplier provides consent, ensuring data is shared securely.

- Direct Data Capture: DIRO retrieves bank account information directly from trusted sources, such as: Banks (44,000+), Utility companies (9,000+), Government portals (700+)

- Automated Supplier Bank Account Verification: Checks account ownership and status in real time.

- Detects tampered or doctored documents.

- Performs procurement fraud and impersonation checks automatically.

- Machine-Readable Output: Verified results are provided in a JSON format.

- Integrates directly into MyAchilles decision engines for automated workflows.

This approach ensures payments go to the right place, and prevents fraudsters from inserting themselves into the process.

Integration with MyAchilles

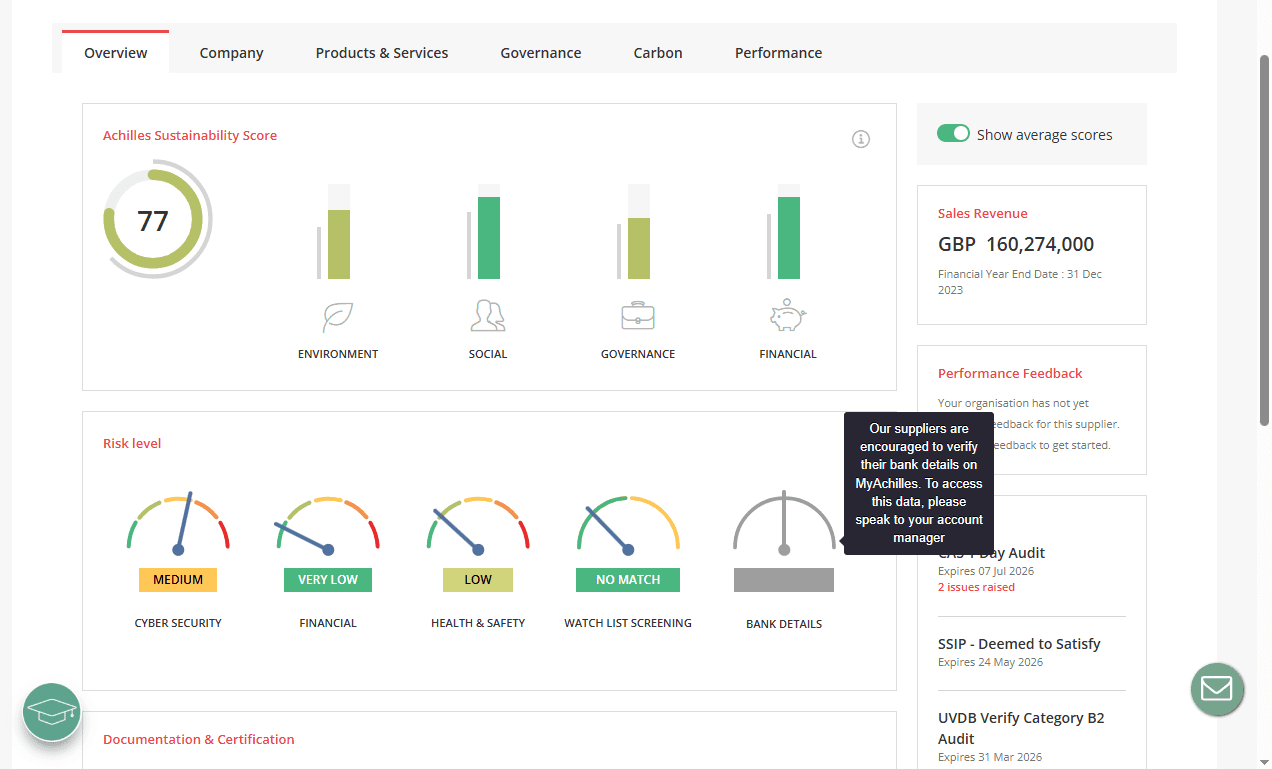

Verified supplier data appears in the risk gauge, giving buyers instant visibility of which accounts are verified. Suppliers can submit verification requests directly from the platform, reducing manual back-and-forth. Full bank details are accessible only within existing buyer–supplier relationships and with the correct permissions, ensuring sensitive data is always protected.

Key Features and Metrics

Achilles + DIRO provides buyers and suppliers with real-time bank account verification to reduce the risk of procurement fraud and improve onboarding efficiency. Key features include:

- Real-Time Verification: Most accounts are verified in under 60 seconds.

- Global Coverage: Access to 195 countries, covering thousands of banks and government sources.

- Fraud Detection: Automatically flags inconsistent or altered documents.

- Compliance Support: Strengthens KYB and AML processes for buyers.

- Workflow Integration: Data flows seamlessly into risk assessment dashboards and supplier decision engines.

Benefits Beyond Fraud Prevention

Adding DIRO to onboarding does more than block push payment fraud attempts:

- Reduced Risk of Human Error: Automated checks replace manual calls and document reviews.Practical Use Cases

- Faster Supplier Onboarding: Supplier bank account verification means fewer back-and-forth requests, speeding up payment approvals.

- Regulatory Compliance: Supports Know Your Business (KYB) and Anti-Money Laundering (AML) workflows.

And with global coverage across 195 countries and connections to 44,000 banks, 9,000 utilities, and 700 government portals, DIRO is built to scale with global supply chains.

Practical Use Cases

Here’s how different users benefit from bank account verification:

- Buyers: Quickly see which suppliers have verified bank accounts, reducing risk of misdirected payments.

- Suppliers: Submit bank details securely, helping ensure payments are received promptly.

- Finance Teams: Automate supplier bank account validation, reduce manual checks, and strengthen compliance reporting.

Best Practices

To get the most out of Achilles + DIRO:

- Encourage suppliers to complete verification early in the onboarding process.

- Monitor the risk gauge regularly to identify suppliers who haven’t verified their accounts.

- Integrate verification results into internal workflows to automate approval and payment processes.

Building Trust, Protecting Payments

Supplier relationships are built on trust, and nothing damages trust like a procurement fraud. By verifying bank accounts directly at the source, Achilles + DIRO protects suppliers and buyers alike, reducing procurement fraud risk and keeping money flowing where it’s meant to go.