In March 2024, the U.S. Securities and Exchange Commission (SEC) adopted new climate disclosure rules designed to bring greater transparency and consistency to how public companies report climate-related risks and emissions. Though these rules were viewed as a major milestone in climate-related financial reporting, they have since been paused and face an uncertain future.

This blog outlines what the rules originally required, the current status of enforcement, and what companies should consider as the regulatory landscape continues to evolve.

Overview of the SEC’s Climate Disclosure Rules

The 2024 climate disclosure rules introduced several requirements for U.S. public companies and foreign private issuers:

- Material Climate-Related Risks: Companies must disclose risks that could materially impact their business, strategy, or financial performance.

- GHG Emissions: Disclosure of Scope 1 and Scope 2 greenhouse gas emissions, if material.

- Climate Metrics in Financials: Companies must report climate-related costs, such as those linked to severe weather or transition risks, in audited financial statements.

- Climate Goals: If a company has publicly set climate-related targets, it must disclose progress against them.

- Phased Implementation: Larger companies were expected to comply first, with smaller issuers given more time.

Notably, Scope 3 emissions (those from supply chains and product use) were excluded from the final rule, although they were part of the initial proposal.

Legal and Regulatory Developments

Shortly after adoption, the rules faced legal challenges from multiple stakeholders, including state attorneys general and business groups. In response, the SEC issued a voluntary stay of the rules in April 2024. This pause allows the courts to consider the legal issues while the agency evaluates next steps.

In early 2025, the SEC withdrew its defense of the rule in court, which strongly indicates that enforcement will not proceed under the current leadership. The agency has requested that oral arguments be delayed, signaling the possibility of either allowing the court to strike the rule down or formally rescinding it through administrative procedures.

What Comes Next?

Several pathways exist for modifying or eliminating the rule:

- Rescission via Rulemaking: The SEC may go through the formal notice-and-comment process to amend or repeal the rule.

- Judicial Decision: Courts may invalidate the rule based on ongoing legal challenges.

- Congressional Action: While the Congressional Review Act is no longer an option, appropriations riders could be used to prevent enforcement.

Until one of these outcomes is finalized, the rule remains paused and is not currently enforceable.

What This Means for Businesses

While federal enforcement of climate disclosure is paused, market demand for transparency remains strong:

- Investors continue to request climate-related data as part of ESG and long-term risk assessments.

- Global regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD), still apply to many U.S.-based multinationals.

- Voluntary standards like the Task Force on Climate-related Financial Disclosures (TCFD) and the ISSB’s sustainability standards are gaining ground as de facto global benchmarks.

Many companies are maintaining their climate disclosure practices or even expanding them, regardless of the regulatory uncertainty in the U.S.

Summary Table: SEC Climate Disclosure Rule Status

Final Thought

The regulatory environment for climate disclosures in the U.S. remains unsettled. But regardless of federal mandates, many companies continue to treat climate-related transparency as a strategic imperative, driven by investor expectations, operational risk management, and international reporting obligations.

Companies should continue monitoring developments while strengthening internal systems for climate data, governance, and risk analysis.

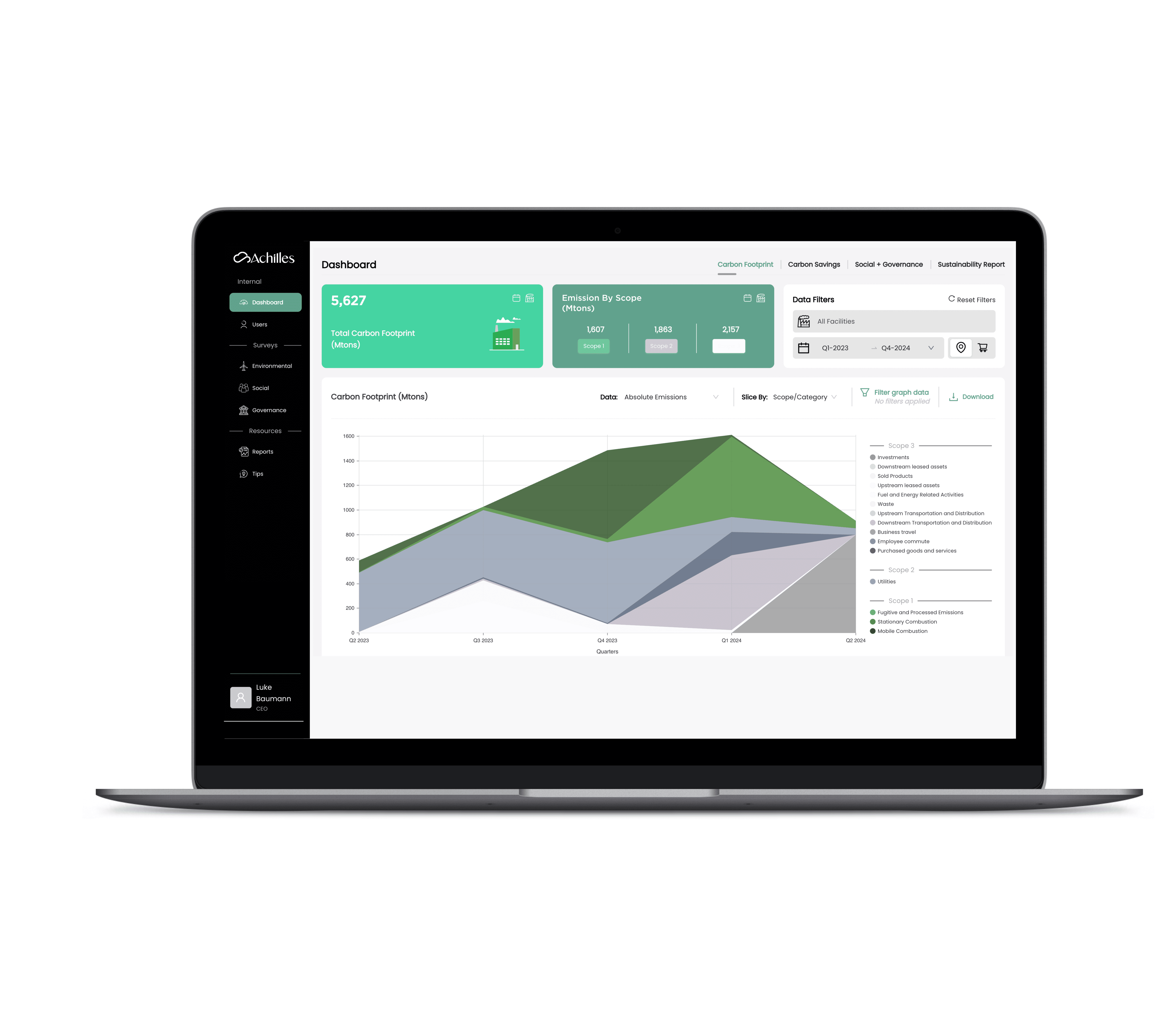

Learn how Achilles helps organisations collect, analyse, report and reduce emissions.

Explore Achilles Carbon Accounting →