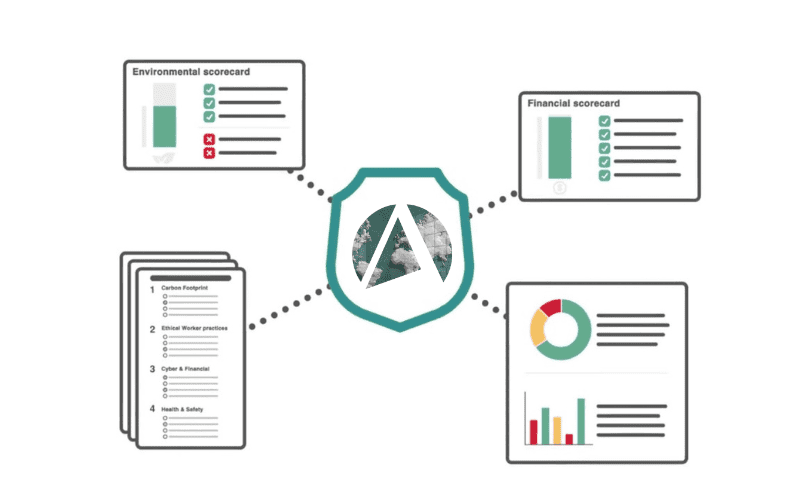

Real-time insurance assurance for your supply chain

Traditional insurance checks rely on paper certificates that quickly become out of date. Achilles changes that with continuous, digital verification direct from insurers.

See how Achilles can help protect your business.